As a general rule, the OZ program provides tax benefits for investors in a qualified opportunity fund (QOF) that engages in business, including the business of renting real estate, in an OZ. Among other requirements, the real estate and other tangible assets used in the business generally must be acquired “by purchase” from an unrelated person after Dec. 31, 2017. In addition, property that was previously placed in service in an OZ will only qualify as qualified opportunity zone business property if it is substantially improved by the QOF. Given these basic requirements, how can a person who acquired property in an OZ prior to 2018 use the OZ program to raise capital for the purpose of improving the property or funding the start-up of a new business that will use the property? As explained below, an existing OZ property owner has a number of options, including selling the property to a newly organized QOF in which the property owner has a less than 20% ownership interest or leasing the property to a newly organized QOF.

OVERVIEW OF KEY OZ REQUIREMENTS

The OZ rules are complex, and many requirements must be satisfied in order to qualify for the new tax benefits from owning and holding a real estate project or other business located in an OZ. Among the key requirements are the following:

OZ tax benefits are only available to an investor who recognizes a capital gain and, within 180 days of recognizing the capital gain, makes a capital contribution to a qualified opportunity zone (a QOF) that, directly or indirectly, conducts business in an OZ.

Real property in an OZ may be held directly by the QOF or by a subsidiary entity that qualifies as a qualified opportunity zone business (QOZB). In practice, due in large part to rules that severely limit the amount of cash and liquid assets that can be held by a QOF, in the vast majority of cases the OZ business will conducted through a QOZB (which can take advantage of a 31-month safe harbor for holding working capital).

For an entity to qualify as a QOZB it must be engaged in an active trade or business (which can include rental real estate) in an OZ and at least 70% of the tangible property owned or leased by the entity must be qualified opportunity zone business property (QOZBP).

To qualify as QOZBP, real estate and other tangible property must be acquired “by purchase” by the QOZB after Dec. 31, 2017 from an unrelated person. To be considered “unrelated” the seller of the property cannot own more than 20% of the capital or profits of the QOZB, either directly or by attribution.

If the QOZB is not the “original user” of the real estate, the QOZB must “substantially improve” the property. This means that the QOZB must, within any 30-month period following the acquisition of the property, make improvements to the property with a cost at least equal to the original cost of the acquired building (the cost of the acquired land can be ignored for this purpose).

LEASED PROPERTY

Prior to the issuance of proposed regulations in April of 2019, there were many questions about how leased property would be treated under the OZ rules. For example, could a QOZB lease property from a related person, could property that had previously been used still qualify as QOZBP and how should leased property be valued for purposes of determining whether a QOZB satisfied the 70% test or the substantial improvement test?

Under the proposed regulations released in April, leased property can qualify as QOZBP, even if it is leased from a related person, provided that certain tests are met. This will allow many property owners to lease property they already own to a QOZB, even if they have a greater than 20% interest in the QOZB. This also allows many operating businesses that lease property to qualify as QOZBs.

For any leased property to qualify as QOZBP, the following requirements must be satisfied:

It must have been acquired by a lease entered into after Dec. 31, 2017.

The lease terms (including any payment terms and extension options) must be market rate at the time the lease is entered into.

In the case of any property other than unimproved land, there can be no option (or plan or intention) to purchase the property for a price other than the fair market value at the time of purchase.

If property is leased from a related person, the following additional requirements must be satisfied:

The lessee cannot make prepayments relating to a period of use that exceeds 12 months from the prepayment date.

If the lease includes tangible personal property which had previously been used on the OZ, the lessee must acquire or purchase additional tangible property in the same OZ that qualifies as QOZBP and has a value at least equal to the “lease value” of the leased tangible personal property. Lease value is equal to the present value of the entire lease stream, as of the date the lease is entered into, computed using the “applicable federal rate.” Under the proposed regulations, the lessee will be deemed the “original user” of property if the property has been unused or vacant for an uninterrupted period of at least five years.

It is notable that the rules for leasing existing property located in an OZ to a QOZB are considerably more flexible than the rules for selling existing property to a QOZB. For example, an existing owner of real estate located in an OZ can lease the real estate to a QOZB that is related to the seller, and leased real estate does not have to be substantially improved to qualify as QOZBP.

CONTRIBUTED PROPERTY

The proposed regulations permit taxpayers to obtain QOZ benefits by contributing property in-kind to a QOF. Since the QOF will not have acquired the contributed property “by purchase,” however, it will be difficult for the QOF to satisfy the 90% asset test unless the contributed property is of low value (not more than 10% of the total value of contributions to the QOF). This approach will likely only be viable in limited situations.

An alternative is for a property owner to contribute property located in the QOZ directly to a QOZB. The property owner will not qualify for QOZ benefits as a result of the contribution, but only 70% of a QOZB’s assets have to qualify as “good” QOZBP. The in-kind contribution to a QOZB means that the QOZB won’t have to make lease payments, transfers all property value to the QOZB, and also avoids any tax to the property owner that would have become due if the property owner sold property to the QOZB. The contributed property will not qualify as “good” QOZBP, which means that the QOZB must build or acquire other assets that represent 70% of the total value of the QOZB. If the owner contributes raw land and the QOZB builds a new building, the new building should be considered a “good” asset. In contrast, if the owner contributes land improved by an existing building, then improvements to the building made by the QOZB would likely not be considered a “good” asset.

PLANNING OPPORTUNITIES

Someone who acquired real estate in an OZ prior to 2018 may well benefit from a general increase in property values attributable to other investments made in the OZ as a result of the OZ program. In addition, if the property in question is a good candidate for substantial rehabilitation, an unrelated developer may well be willing to pay a premium price to buy the property from the existing owner. In the case of an existing owner of OZ property who wants to use the OZ program to raise capital for either the improvement of the property or to start a new business in the OZ, the following three options should be considered.

Sale to Unrelated QOZB: The owner could sell the real estate to a QOZB in which the owner will have a 20% or less ownership interest (directly and by attribution). The owner can manage both the QOZB and the parent QOF, but the owner’s interest in capital and profits cannot exceed 20%. (It is usually prudent to keep ownership below the 20% level to provide a margin for error.) Assuming that the property had previously been placed in service, the QOZB would need to make substantial improvements equal to the cost of the existing building. The owner can defer gain from the sale of the property by investing in the QOF that controls the QOZB, subject to the requirement that the owner’s ownership must not exceed 20% of total capital or profits. Any “excess” capital gains could be deferred by investing in one or more additional QOFs.

Lease the Real Estate to a QOZB: The property owner could lease the property to a QOZB at market rate terms. The leased property will generally qualify as QOZBP in the hands of the QOZB, even if the owner of the property owns more than 20% of the QOZB. For example, real estate that does not require substantial improvement could be leased to a QOZB that will use the property in the conduct of an active, non-rental business. If the property owner owns more than 20% of the QOZB and any of the leased property is tangible personal property that was previously used in the OZ, the QOZB will need to build or acquire additional tangible property in the OZ that qualifies as QOZBP had has a value at least equal to the lease value of the leased personal property.

Contribute the Property to a QOF or QOZB: In some circumstances, the property owner could contribute the property to a QOF or QOZB in exchange for equity in the QOF or QOZB. This approach generally only works where the property has a low value relative to the other property to be built or improved by the QOF or QOZB. A contribution to a QOZB is easier than a contribution to a QOF because of the higher permitted level of “bad” assets at a QOZB (30% rather than 10%).

Example

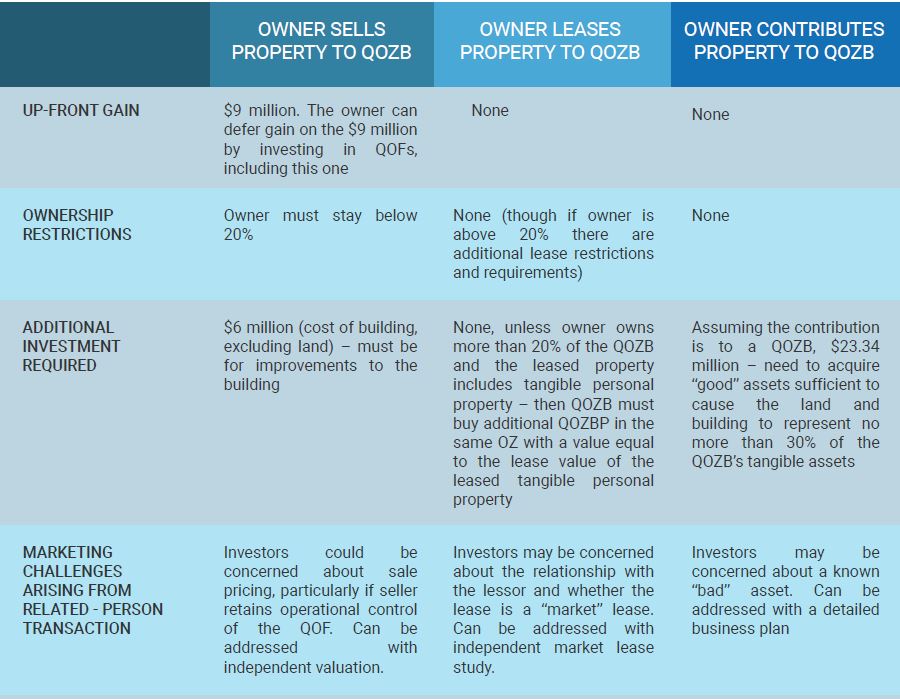

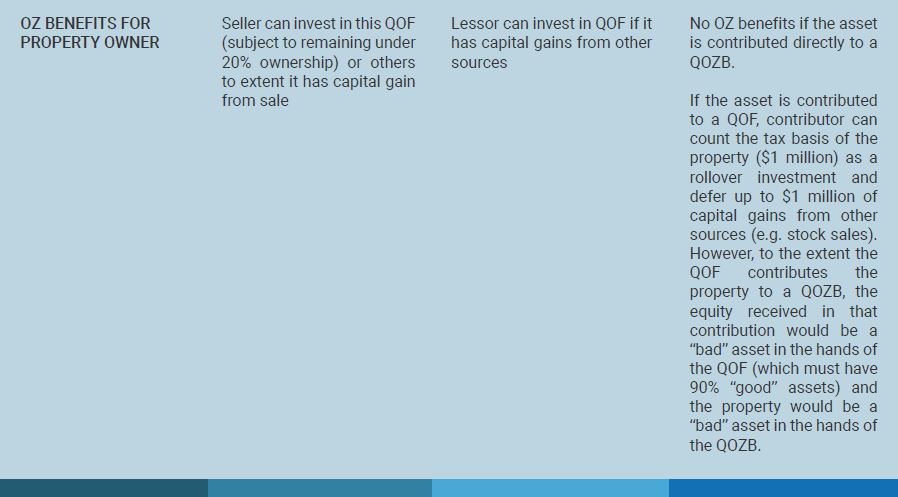

The following example illustrates the main consequences of each alternative structure:

Assume that the pre-owned property is land valued at $4 million value with a building valued at $6 million, has a tax basis of $1 million, and in the lease scenario, the property is leased for 30 years, and the present value of the lease stream is $12 million. The consequences of each alternative approach are summarized below.

Note that in all cases, the prior asset owner can control (from a governance/voting perspective) the QOF and QOZB as long as the relevant economic tests are met.

An owner of opportunity zone property, even property acquired before 2018, has several planning opportunities to enable the owner to take advantage of the opportunity zone benefits to raise capital and attract financing – and even to invest in the pre-owned property in a way that qualifies the current owner for OZ benefits. There is no “one size fits all” solution, and in some cases, multiple approaches can be combined even with the same property or group of properties to achieve optimal results.